Da Kid was close to graduating from high school when he started making "car noises."

He already had access to one: a used Bronco I'd picked out for him, bought and insured. It might have been a gas guzzler but when your child starts driving, you

really want something reliable with a high . . . erm, crash safety rating.

Da Kid knew neither his father nor I had any plans of buying him a different vehicle. He, however, had it all figured out. He would.

I told him fine, adding as gently as I could (Riiiiiiiight!) that he'd have to do it completely on his own. From scratch since he would NOT be using the Bronco as a trade-in and he'd also be completely responsible for his own insurance, too.

The kid agreed.

About a year later Da Kid had it all figured out. Or, he thought he did.

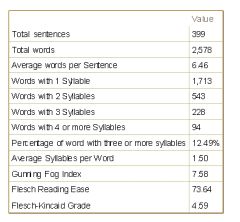

Between the pay from his job and how much he'd save in gas by NOT driving the Bronco, he could afford $X a month. Then deducting from that $X for auto insurance and $X for a car payment, he'd still have $X left each month.

I asked him how he'd gotten his cost figures and he proudly showed me.

He'd put a lot of work into it checking various online auto sites, and based upon the prices quoted for the

brand new completely loaded MUSTANG he wanted, and their helpful online monthly payment calculators . . .

I said I didn't think so, but you know the way it is. What do I know. I'm only his mother.

As fate would have it, one of those multi-dealership massive car sales was underway down at the Fairgrounds so we took a trip over. And there was Da Kid's car! His dream MUSTANG!

By the time the figures were done, Da Kid realized how badly he'd miscalculated. Not only couldn't afford the Mustang, he couldn't finance

any vehicle.

Not then, anyway.

First, he didn't have enough saved for a down payment that would make any appreciable difference in the monthly payments. Secondly and even more importantly, it's not that he had a bad credit rating. He didn't have enough much of a credit history at all. Just his always-on-time monthly cell phone payments.

A few days later we took a trip to the credit union I've been a member of for

mumble- something years. I didn't know if it would work, if they'd approve it, but it made sense to me. My diabolical plan for improving Da Kid's credit rating apparently made sense to their loan officer, too, because when Da Kid and I left, he'd been approved for a one-year, $1,000 personal loan, secured by his new savings account into which he'd deposited $1,000.

Da Kid paid the loan off in five months not because he couldn't or didn't want to pay the loan off earlier. If he had, as the loan officer had advised him, it wouldn't have affected his credit rating the way he needed it to.

That was a little over three years ago.

Shortly thereafter between what additional money he'd saved and his much-improved credit rating, Da Kid pulled up in his new vehicle.

New not because it was, but new because this was Da Kid's first all-on-his own vehicle.

A Mustang? Hell no.

A far more practical two-year-old BUT still under-factory-warranty extend-cab Ranger.

Just about an hour ago — paying the loan off two year's early — Da Kid showed me its title.

"It's mine."

(The Bronco? It's still going strong. Hubby's driving it now.)